Want to find out more about Non-Commodity Costs? We’ve written a more recent article which you can find here!

S o just what are Non Commodity Costs? Compared to previous years, we can see that the wholesale energy market in the UK is low. More specifically, average wholesale energy prices have fallen more than 14% in the last five years! From 2013 – 2016, prices plummeted more than 23%.

Given that, you’d be forgiven for expecting to see some HUGE savings on your energy bills. So what are non commodity costs and what effect do they have on your energy bill?

Unfortunately, the exact opposite is happening – everyone’s energy bills are rising at an alarming pace!

If prices are going down, why are my bills going up?

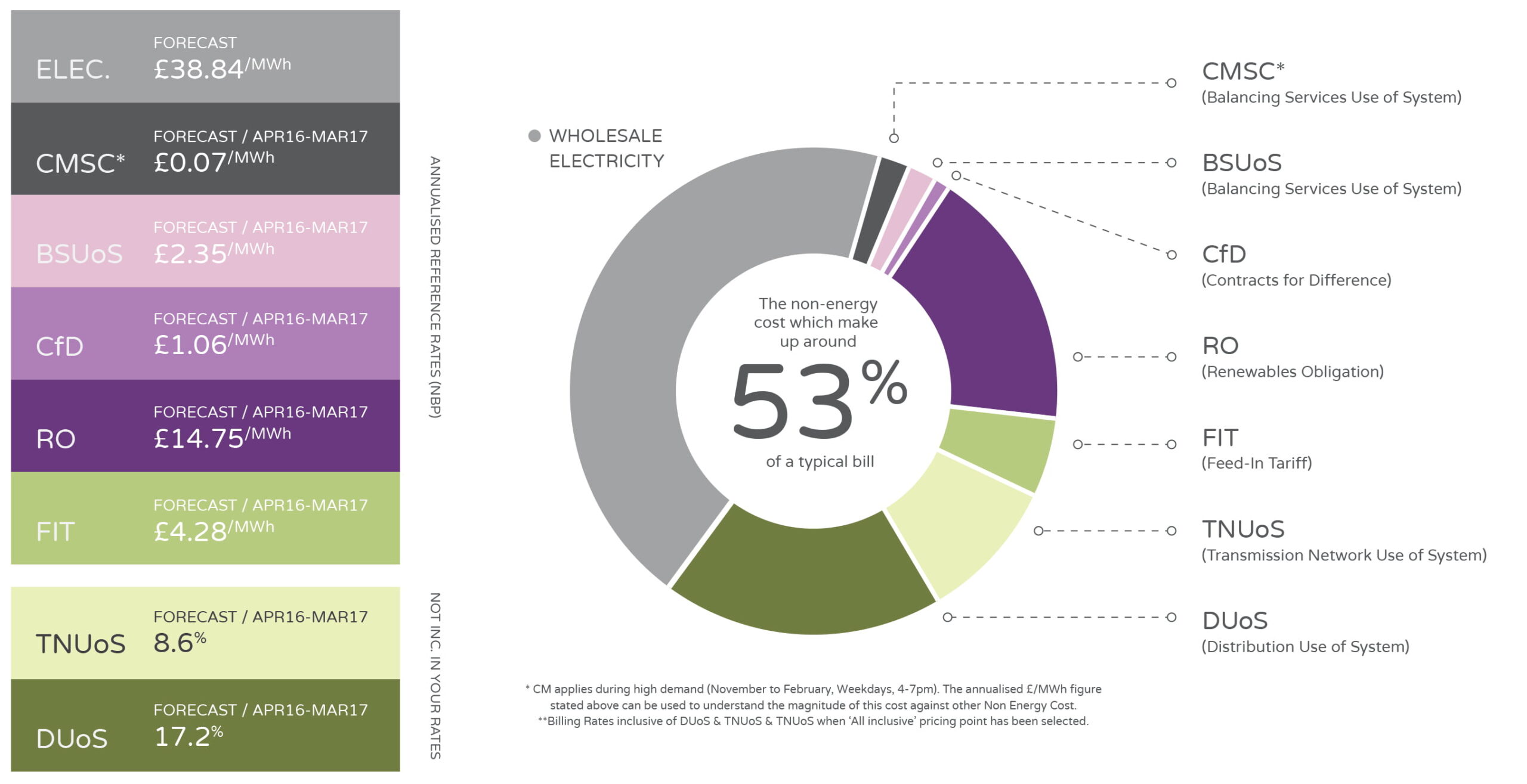

Simply put, non commodity costs. In other words, other charges that make up your bill but are not for the energy itself.

Naturally, no one talks about non commodity costs.

All you hear about is “falling energy prices” because it’s far more exciting to hear that energy prices are falling (which is technically true) than it is to hear that by 2020, non commodity costs will account for at least 60% of your energy bill.

To put that into perspective, a site with an annual consumption of 1,000,000 kWh will see an increase in the cost of approximately £21,000 between 2017 and 2020 even if the wholesale cost of energy does not change.

So, what are you actually paying for?

This is by no means a comprehensive walk-through of the entire suite of non commodity costs (nobody has time for that!) but we’re going to explore some of the most important ones and the impact they have on your business.

Over the next few years, you’ll start to see some of these additional items appearing on your bill and the graph above demonstrates the rising costs – the higher the bar, the higher the cost!

The key Non Commodity Costs can be

separated into one of two categories:

Transportation & Distribution Charges

TNUoS (Transmission Network Use of System Charges)This covers the cost of transmitting electricity from power stations to grid supply points across the transmission system. TNUoS charges recover the cost of installing and maintaining the transmission system in England, Wales, Scotland and offshore.

BSUoS (Balance Services Use of System Charges)This relates to the costs of the day-to-day operation of the transmission system. Basically, this is a sophisticated operation that makes sure there is always just the right amount of energy pulsing around the network to avoid wastage or blackouts. With the integration of solar panels, wind turbines and other renewable energy sources, the grid is being forced to manage more and more generators and is dependent on the weather (which is unpredictable at best!) for its stability which makes it harder and more expensive to manage.

DUoS (Distribution Use of System Charges)DUoS charges are levied by DNOs (Distribution Network Operators) and go towards the development, maintenance and operation of the UK’s national energy distribution networks. In the simplest of terms, it covers the cost of moving electricity from the national grid to your premises.

Commissions, Government Levies and Taxes

FiT (Feed-in Tariff)This is a government tariff designed to accelerate investment in renewable energy technologies. If you have solar panels, you can save money by generating your own electricity and you’ll get paid for any extra electricity you generate. If you don’t have solar panels, you’ll be paying FiT as part of your energy bill to fund the people who do!

RO (Renewables Obligation)The RO charge has simply been designed to help the government meet its 2020 target of having 15% of the energy generated from renewable sources – another example of customers footing the bill for infrastructure investment!

CM (Capacity Market)The CM charge is designed to incentivise investment in more sustainable, low-carbon energy capacity at the lowest cost for energy consumers. This is a charge paid for by electricity consumers on their consumption in the winter period (a charge to keep the lights on!)